North Carolina Annual Withholding Reconciliation

Human Resources > State Requirements > NC > Annual Withholding Reconciliation

An ![]() Annual Withholding Reconciliation option has been added to the North Carolina State Requirements menu. Use this option to generate the North Carolina Annual Withholding Reconciliation reports and transmittal file.

Annual Withholding Reconciliation option has been added to the North Carolina State Requirements menu. Use this option to generate the North Carolina Annual Withholding Reconciliation reports and transmittal file.

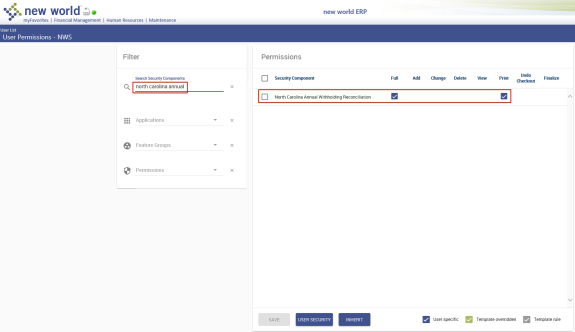

For the option to appear on the menu, each user needs permission to a new security component, North Carolina Annual Withholding Reconciliation.

- Navigate to Maintenance > new world ERP Suite > Security > Users. The User List page opens.

- Select the user’s row.

- Click Permissions. The User Permissions page opens, containing a grid of security components and a filter panel.

-

In the Search Security Components filter, type Indiana North Carolina Annual (the entry is not case sensitive). The grid refreshes to contain the

North Carolina Annual Withholding Reconciliation security component only.

North Carolina Annual Withholding Reconciliation security component only. - Select Full permission.

- Click Save.

- For the permission to take effect, the user needs to log off and log back onto the system.

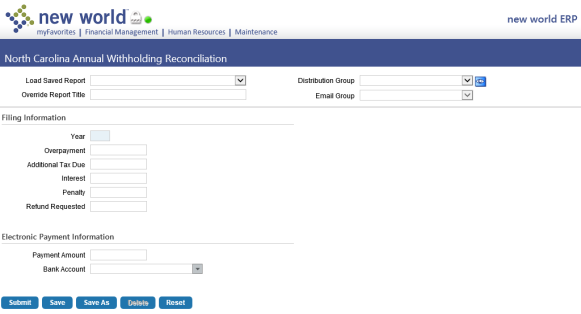

To generate the North Carolina Annual Withholding Reconciliation reports and transmittal file, navigate to Human Resources > State Requirements > NC > ![]() Annual Withholding Reconciliation.

Annual Withholding Reconciliation.

In the output generated, tax amounts withheld for the year are compared with tax amounts reported on W-2s.

If W-2s have not been created when you run this option, a message will alert you.

The only required entry is Year. The remaining fields are override fields.

We recommend that you first run the reports and transmittal file with only the Year filled in, then review the results to determine whether adjustments need to be made using the override fields or W-2s need to be recreated and the reports and transmittal file re-run.

If the reports show an underpayment condition and you will make installment payments using the transmittal file, you may use the Payment Amount field to fill in the amount being paid. Use the Bank Account field to select the account from which payment will be made. The Bank Account drop-down contains the list of accounts to which you have access. It is the same field you see when processing an accounts payable or payroll payment batch.

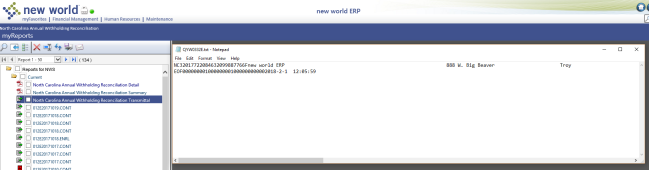

After making your selections on this page, click Submit. The North Carolina Annual Withholding Reconciliation Summary, North Carolina Annual Withholding Reconciliation Detail and North Carolina Annual Withholding Reconciliation Transmittal files will be generated and sent to myReports.

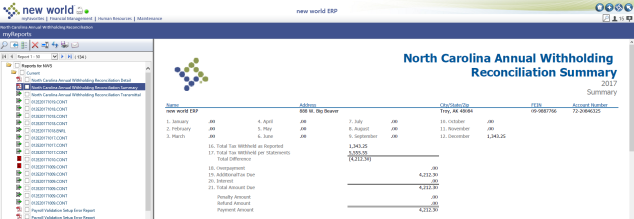

![]() North Carolina Annual Withholding Reconciliation Summary

North Carolina Annual Withholding Reconciliation Summary

This report summarizes withholding data for the organization, showing the taxes withheld per month, the amount withheld as reported, the amount withheld per W-2 statements, the difference and the data for the rest of the fields that are found on the annual reconciliation form.

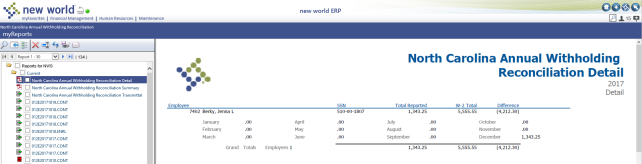

![]() North Carolina Annual Withholding Reconciliation Detail

North Carolina Annual Withholding Reconciliation Detail

This report shows the month-by-month withholding detail for each employee.

![]() Norther Carolina Annual Withholding Reconciliation Transmittal

Norther Carolina Annual Withholding Reconciliation Transmittal